Stock market cycles provide valuable insights into market movements, allowing investors to make informed decisions about buying and selling stocks. In this blog, we will explore how to utilize stock market cycles to predict market movements and execute profitable trades.

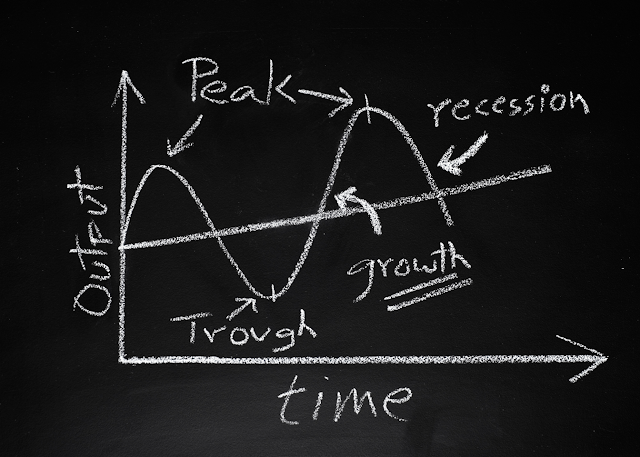

Understanding the various types of stock market cycles is crucial. The business cycle, the most widely recognized cycle, encompasses phases of expansion, peak, contraction, and trough. During the expansion phase, the economy grows, and stock prices rise. The peak phase represents the economy's highest point and stock prices reach their zenith. In the contraction phase, the economy shrinks, and stock prices decline. Finally, the trough phase signifies the economy's lowest point and stock prices hit their nadir.

Another important cycle to comprehend is the market cycle, which entails bull markets (rising stock prices) and bear markets (falling stock prices). Bull markets are marked by optimism and upward trends, while bear markets are characterized by pessimism and downward trends. It is noteworthy that bull and bear markets can occur within any phase of the business cycle.

To effectively predict market movements using stock market cycles, investors should monitor indicators signaling new phases in the business cycle or transitions from bull to bear markets. Economic indicators like gross domestic product (GDP), employment data, and inflation rates offer insights into the state of the economy and aid in anticipating new business cycle phases. Additionally, stock market indicators such as the Dow Jones Industrial Average and the S&P 500 can serve as signals for bull or bear markets.

Timing is a critical factor when utilizing stock market cycles for predictions. Consider the length of the current cycle and the time elapsed since the previous market bottom or top. For instance, if a market bottom occurred three years ago and the average cycle duration is four to five years, it may be an opportune moment to enter the market.

Furthermore, relying on multiple indicators rather than a single one enhances the accuracy of predictions. Combining economic data, stock market data, and sentiment analysis provides a more comprehensive market overview. It is essential to acknowledge that stock market cycles are not always predictable and can be impacted by unforeseen events. Therefore, maintaining a well-diversified portfolio and investing within one's means is crucial.

Understanding stock market cycles and using indicators to forecast market movements can be advantageous for investors. By paying attention to economic indicators, stock market indicators, and timing, investors can make informed decisions about stock trading. However, it is vital to employ multiple indicators and bear in mind that stock market cycles can be influenced by unexpected events. Always diversify your portfolio and invest wisely.

Stock market cycles offer valuable insights into market movements, enabling investors to make informed decisions about buying and selling stocks. In this blog, we will explore how to leverage stock market cycles to accurately predict Bank Nifty movements, excel in intraday day trading, and succeed in real-time commodity investing. We will also discuss the Elliott Wave Theory, bullish and bearish markets, trade cycles, and the significance of Dow Jones historical data.

To predict market movements successfully, it is crucial to understand different types of stock market cycles. The business cycle consists of four phases: expansion, peak, contraction, and trough. Additionally, market cycles encompass bull markets (rising stock prices) and bear markets (falling stock prices), which can occur within any phase of the business cycle.

When it comes to Bank Nifty, monitoring economic indicators such as GDP, employment data, and inflation rates becomes paramount. These indicators provide insights into the state of the economy, helping investors anticipate shifts